Modern geospatial

It's Geo, but not as we know it.

We have introduced complementary assets, inchoate demand, and adjacent possibilities in the past few months. We have talked about innovation curves, market segmentation and market sensing. We have taken these general concepts and applied them to the present state of geospatial technology.

My thesis is that we are on the cusp of a new era in geospatial. In fact, we have been on that cusp for some time, but our community’s horizons have been artificially constrained. This is a critical moment for those willing to step out of our little geospatial community practice and stand in the arena. As Gandalf said, this is the deep breath before the plunge.

I have talked to my team endlessly about the nature of Modern Geospatial. I am quite sure they are bored of this discussion. But in broader terms, understanding what Modern Geospatial is and what it means is important to the development of our community. Because the activity patterns are not the same as those of the traditional GIS community. The workflows are different; the technology stacks are different; the audiences are different; the interfaces are different, but the underlying geographic concepts are familiar.

This article will examine the people, technologies, demand and some innovation curves involved in what I think is a new market opportunity.

Who is geo?

The who is geo is changing. While the GIS analyst was once the primary user of geospatial data, I now wonder if that is still the case.

What’s more important is that the future consumer of geospatial data and technology should not be the exclusive realm of the GIS or geospatial expert. Most geospatial tools, except for a handful of notable exceptions, have been made by geospatial users for geospatial people. Clearly, there are more non-experts than there are geospatial people. And, as we will see, there is demand in other sectors to support broader adoption. The gap is capacity, knowledge or interpretation.

In short, the who of geospatial is now everyone who owns a smart device. That’s a significantly greater addressable market than that of people who can drive a GIS.

New assets

We are seeing the rise of a series of complementary assets which have changed our ability to deliver geographic knowledge.

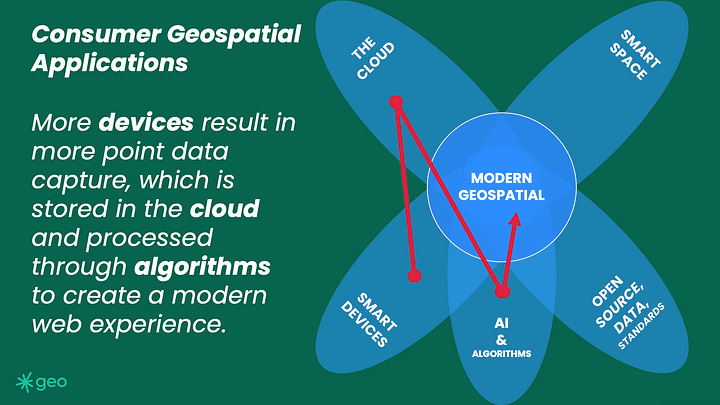

The Cloud | Smart Space | Openness | Smart Devices | AI & Algorithms

This list is not exhaustive and will change. But, with each of these assets comes a series of new capabilities that can open doors to new opportunities and even new markets.

Additionally, as each of these assets independently advances, we will see the net effects on geospatial. While the cloud has been advancing steadily over the last decade, smart space and AI have also made enormous strides. How will large Language Models influence geospatial? Indeed, does ChatGPT explicitly understand space? Do we need a Large Geospatial Model? Likewise, smart devices can now capture LiDAR; how will that change our understanding of interior mapping? Will our mapping interfaces change orientation from planimetric to first-person or audio?

When we consider the wider technology ecology in which geospatial sits, we can quite quickly see that the general patterns of GIS that most geospatial people of a certain age cut their teeth on have become a much smaller part of a broader horizon of possibility. More importantly, we can start to see new patterns emerging: Consumer Geospatial is one, and EO Derived Analytics another

These new patterns demand evolving organizational structures. Interestingly, partners are becoming more important; perhaps this will change with more consolidation. But presently, strategic partners and marketplaces are emerging enablers.

New demands

The seemingly chicken and egg debate around commercial Earth observation has become a huge barrier to adoption. On the one hand, we have much more data flowing out of Low Earth Orbit, but there isn’t enough human or technical capacity to use those pixels. However, once that capacity develops, we will need much more sensory capacity, which will take time to launch.

I have talked about the missing middle recently. Identifying that there is a lack of technical capacity and market intermediaries in the EO and geospatial markets.

However, we can see that pixels or active response data are the only way to measure scale landscape changes. That scale will be necessary to measure supply chains, climate-related finance concerns, risk management for insurance and re-insurance, and broad asset portfolio management. So, though a lack of technical capacity exists, we can observe that there must be a demand for the capability.

That lack of capacity also affects the general knowledge of what geospatial can do; leaving geospatial people talking to other geospatial people (see above, again.)

New curves

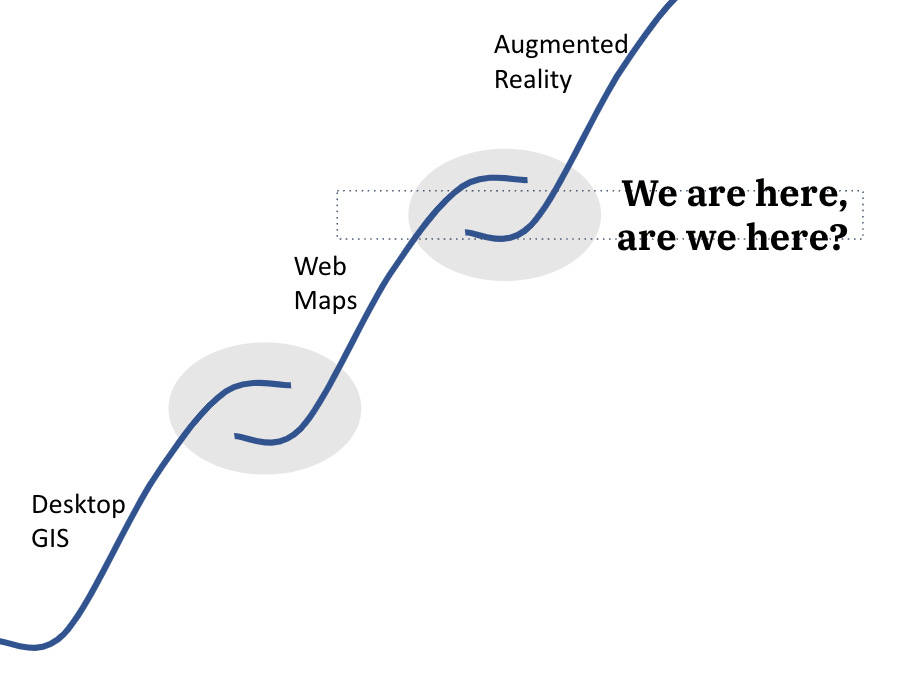

Though annoyingly subjective in most cases, innovation curves are a handy visualization tool. In essence, we use them to help us estimate the state of a technical capability.

In the case of web mapping, for instance, we can see that we are somewhere between web maps and augmented reality. This is not to say that Desktop GIS will disappear, but that that tool is not state-of-the-art. We can also argue about when hybrid GIS applications become web solutions. The key point here is to consider when technologies become mature.

More important still is to consider when a technology becomes mature for a particular industry. For instance, the technology sector in Silicon Valley has committed to cloud technology for well over a decade. Though there are some detractors now, for the most part, the scalability and flexibility offered by the cloud are transformational for startups and technology companies. However, this is not the case for the finance sector in the UK or the resource sector in North America. The innovation curves for those industries are vastly flatter than those of the tech sector. This is an important note because adoption and innovation are different. This difference in curve steepness can lead to a long gap between proofs of concept and industry adoption. That gap can kill companies.

Regarding Modern Geospatial, we must consider what innovation curves mean and which one we want to be on. Each one of us should have a different answer to that question. Different companies have and need different levels of comfort with new technology.

With new technology comes risk | With old technology comes risk.

New strategies

New people, new capabilities, new demands, and new innovation curves. Each of these should require a strategic rethink for our organizations and companies. But together, I argue that we are operating in an entirely new market. Some will be willing to embrace this opportunity; some will have a much harder time adapting.

As we stand on our industrial cliff’s edge, summoning the courage to leap, we wonder how cold the water is and where the rocks are. Remember that, in reality, we have little choice but to leap. Time can be our greatest ally, but ultimately, if we refuse to plunge, time will mercilessly shrug us off our edge.

It is much better to leap with intent than fall or be pushed.

Find your intent; find your modern geospatial strategy.

Jump in, the water’s fine.