Sensing markets

Market knowledge is resilience

Hey team,

How well does your organization sense? And, if any interesting observations are sensed, how are those shared? This discussion is really about how to sense. But it’s reasonable to ask what I mean by sensing and why that would be useful.

Market sensing is simply listening to your entire value chain to determine evolving trends and attitudes. That means talking with customers but also looking at suppliers and your supplier’s suppliers too, and of course, don‘t forget your competitors, rivals or jurisdictional equivalents. That sounds ludicrously simple: just talk. But it’s harder than that; you need to listen too.

The key benefit to market-sensing is knowing what others are doing. This is an incredibly important activity for both the development of new ideas as well as yard-sticking alternative approaches. Sensing can:

Indicate how your competitors and partners approach problems and position themselves

Monitor the evolution of complementary assets

Identify movement on s-curves, indicating a technology re-evaluation

Help direct business development, marketing, and research activities

Note that the first three points are external activities and the final point is an organizational response. Ultimately, market-sensing is how an organization monitors externalities and is; a resilience tool. Call it future-proofing if you want to sound whizzy, but any modern organization needs to understand its changing context, avoiding this activity is verging on irresponsibility for an employer.

That said, not every organization identifies a need to sense. Maybe you are satisfied doing exactly what you are doing. You might be convinced that your team is close to perfect. You might be “laser-focused” on the execution of a well-understood process. Sometimes too much sensing can add complexity to a process that just needs to be “done.” Even saying those words makes me a little uncomfortable and wary, but there are cases where complete focus on execution is the right thing to do. For every other time, there is market sensing.

Sensing is an activity which should be consistent rather than one-off. That doesn’t mean lots of daily activity: there is certainly a balance to be struck between everyday activity and sensing activities. Think of sensing as lightweight monitoring of industry trends.

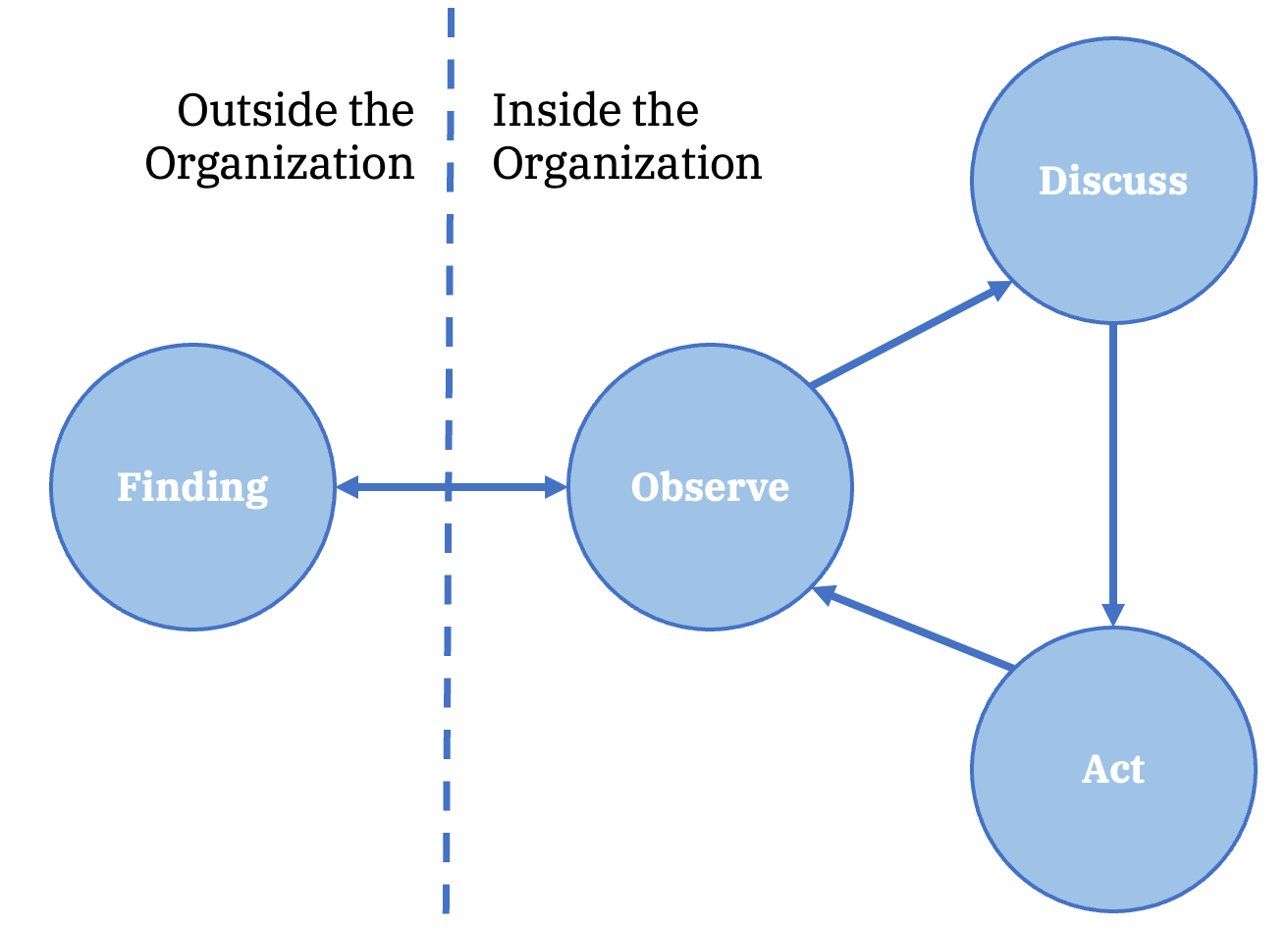

In the cycle indicated above, an individual observes a finding, then that finding is discussed, and action is undertaken, prompting further observation. This is almost embarrassingly simple. The devil is in the organizational detail. I really mean organization here because so many companies do not allow communication to flow. A subject for the future will be the difference between organizational structure and communication structure. But too often when communication is blocked, market sensing is left only to those who are empowered to do it: usually the privileged top leadership. Ironically, those are the individuals who are removed from the actual day-to-day activity. In short, probably the wrong people. In another future discussion, I will touch on organizational ego, but for now, let’s just assume that sometimes organizations have positive and negative human-like features and behaviours. These characteristics can be seen in organizational structure. In particular, your organization’s sensing capacity will also be blocked if communication structures are blocked.

Sensing

The actual activities of sensing could involve attending a webinar, a phone call, a tweet, an email, or any number of communication types. But critically, sensing involves having some kind of context to the observation. The space between the context and observation is the opportunity to be discussed. That is the change which may or may not make a difference. So this means that whoever picked up the observation needs to know that a piece of information is novel and worthy of note. We are sensing for novelty. This also means that sensing is a continuous activity, this needs to be a well-trained organizational muscle.

Sharing

If only one person knows a new thing in your organization, then sure, that individual has sensed something, but your organization has not. Sharing that observation is absolutely critical to building a sensing capability. This means that time must be set aside to do that. That investment in time means that your organization must value sensing. Or at least value the result of sensing. That said, time shouldn’t be set aside if no sensing has happened. Meetings for the sake of meeting are the death of organizational culture. This sensing capability must be joined-up.

Acting

Hopefully, your team is able to talk things through and value robust yet respectful dialogue. On the assume option that you have done that, then you need to be able to act. Sounds simple, but this is the hardest bit. Knowing when to change is the subject of a library of business books. But identifying a meaningful direction and leading a change from sensed intelligence is critical. Most often in sensing discussions, the outcome will be one of:

That’s really interesting, let’s just pay attention to that trend for now.

Can we run a proof of concept to see if this new trend might make sense?

Hmm, interesting, but I don’t think that makes sense for us now.

But, even if the trend or technology is dismissed, the concept is captured in meeting notes and the minds of the participants, adding to the context of your team and organization.

Sparkgeo: a sensing organization

We have tried to create an environment designed to sense. This activity is critical for us because we provide advice and our advice gets better when our team is able to draw from a deeper context.

The more we know, the better our advice is.

At Sparkgeo, we hire for curiosity. It is hard to determine from a resume if someone is truly curious, but it does become evident from their behaviours online and during an interview. Curious people tend to sense naturally, which for us, is magical.

To sense, we use a number of tools. We attend a variety of conferences, but we weigh more towards innovation events rather than sales events. This way we actively learn, and those people we talk to will provide real industry opinions rather than polished slide decks. Engineers and product managers tend to be more grounded in technology reality. Additionally, as engineers, we can pull some very specific domain knowledge from these events. But the difference between those opinions and the glossy decks is market sensing gold dust. We are also very present and active on social media, especially Twitter and LinkedIn. That active engagement builds personality and trust.

We have developed thematic guilds that regularly meet and share ideas. Those guilds also host intra-company hackathons. Our guilds guide our research and technology development agenda and are open to anyone joining. While guilds are our sharing capacity, we have a research team which provides our acting capacity.

That’s what we do, but we are always learning, I would love to hear how your organization senses, please comment below!

In agriculture, our field team pays close attention to the purchase habits of our competitors. It signals other companies sentiment towards the volume of crop available, as well as the quality available. Comparing those moves to our own internal crop estimates we can get a sense of how to position ourselves as harvest approaches. It’s been said that good farm management practices and crop estimates are the bulwark against the longs and shorts of the market. (Not my words, sadly, but good ones)